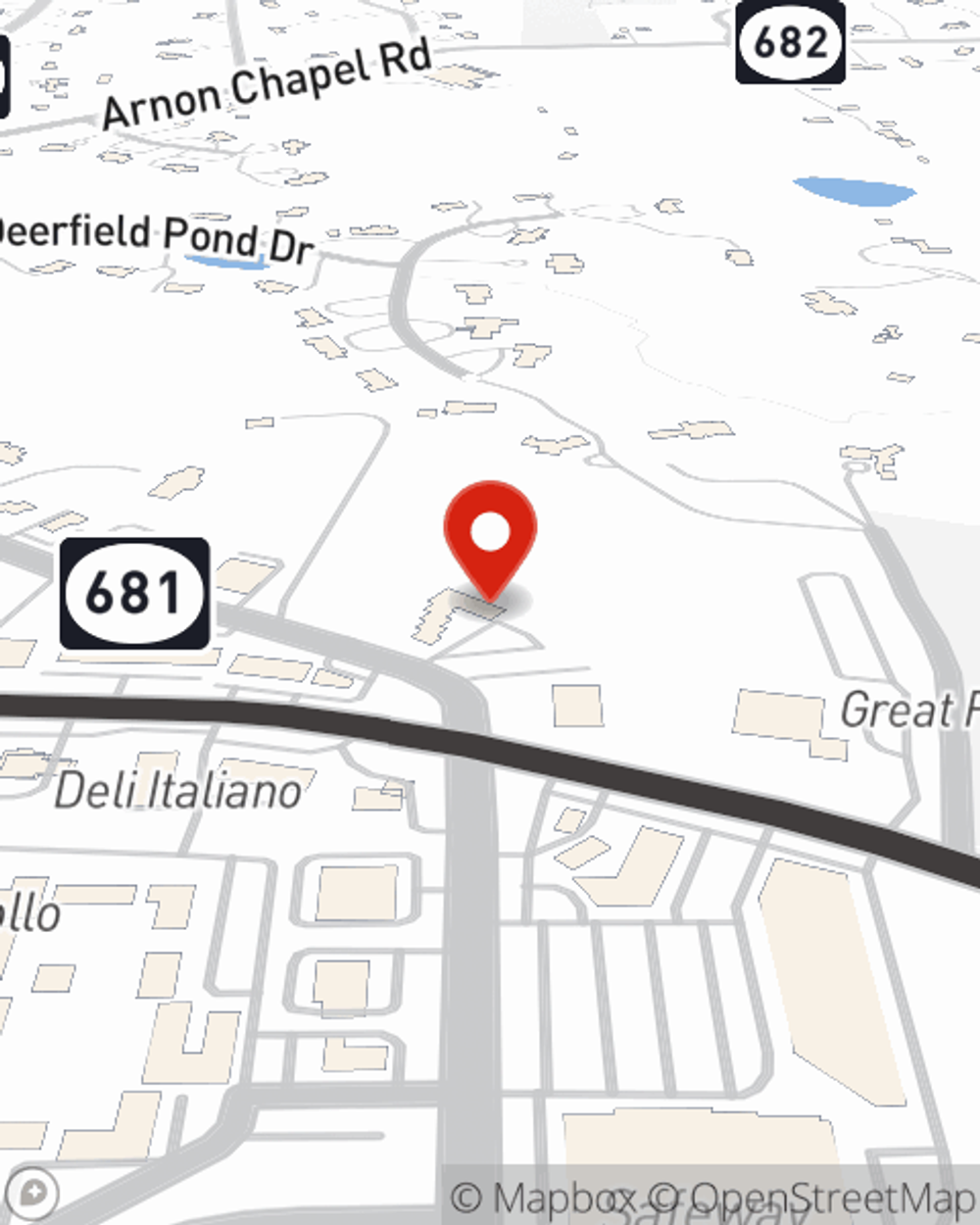

Life Insurance in and around Great Falls

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

It may make you weary to think about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to your family.

Life goes on. State Farm can help cover it

What are you waiting for?

Why Great Falls Chooses State Farm

Choosing the right life insurance coverage is made easier when you work with State Farm Agent G Stephen Dulaney. G Stephen Dulaney is the compassionate associate you need to consider all your life insurance needs. So if you pass away, the beneficiary you designate in your policy will help your partner or your family with certain expenses such as childcare costs, utility bills and college tuition. And you can rest easy knowing that G Stephen Dulaney can help you submit your claim so the death benefit is presented quickly and properly.

With responsible, caring service, State Farm agent G Stephen Dulaney can help you make sure you and your loved ones have coverage if the unexpected happens. Call or email G Stephen Dulaney's office now to discover the options that are right for you.

Have More Questions About Life Insurance?

Call G Stephen at (703) 759-4155 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

G Stephen Dulaney

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.